40+ are points on a mortgage tax deductible

One point equals 1 of the mortgage loan amount. If the amount you borrow to buy your home exceeds 750000 million.

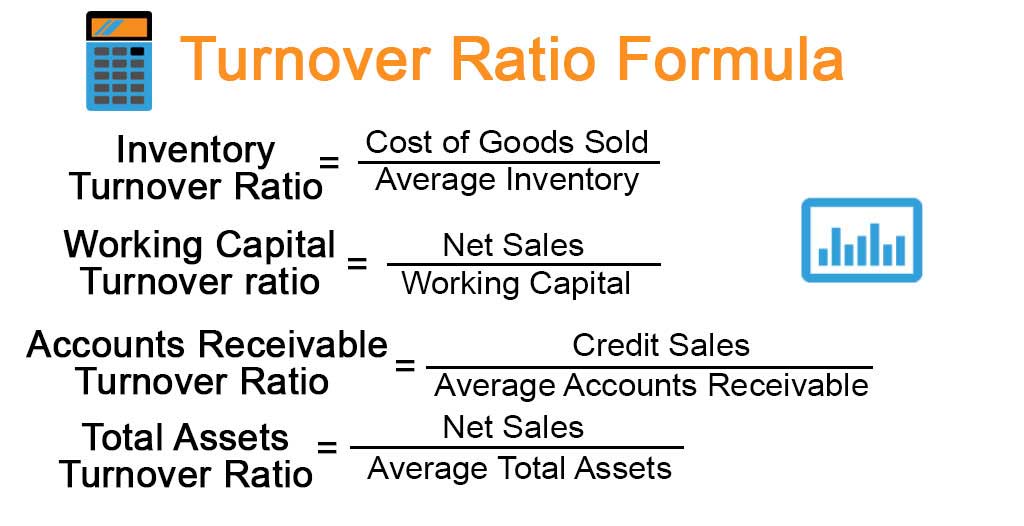

Turnover Ratio Formula Example With Excel Template

Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat.

. Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions. Web Discount Points Deductions. Homeowners who bought houses before December 16.

Web Mortgage points are prepaid interest on your home loan in order to get a reduced interest rate. Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them. Comparisons Trusted by 55000000.

That reduced rate can mean a good amount of savings on a. Web Is mortgage insurance tax-deductible. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Web For mortgage interest to be deductible the mortgage must be secured by your home and the proceeds must be used to build buy or substantially improve your. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. The mortgage is used to buy build or improve the home and the.

Ad 10 Best Home Loan Lenders Compared Reviewed. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Lock Your Rate Today.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Web Most homeowners can deduct all of their mortgage interest.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web For example if your mortgage points totaled 5000 and you took out a 15-year fixed youd be able to deduct roughly 333 annually 5000180 months 2778 x. Web Mortgage discount points also known as.

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Web Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Get Instantly Matched With Your Ideal Mortgage Lender.

Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate. Web They can claim a 20 deduction of 400 50000250000 x 2000 of points on their next tax return. Web What are mortgage points.

They must deduct the remaining points over 360. Web Yes you can deduct points for your main home if all of the following conditions apply. Theyre equal to mortgage interest paid up front when you receive your mortgage.

Families In Eu 15 A Sterreichisches Institut Fa R Familienforschung

The 9 Best Credit Cards For Paying Your Taxes 2023

Tax Shield Formula How To Calculate Tax Shield With Example

Small Business Tax Deduction Tips

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

Tpo Non Agency Products Credit Reporting Qc Home Insurance Fee Collection Tools Mortgage Apps Skyrocket

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction How It Calculate Tax Savings

Canadian Mortgage App Apps On Google Play

Warehouse Processing Homeowner Insurance Products Jumbo And Non Qm News Credit Suisse Mbs Settlement

Can I Deduct The Buy Down Points On A Mortgage Credit

Mortgage Interest Tax Deduction What You Need To Know

Living Arrangements Trends Of 25 34 Years Old In The United States Oc R Dataisbeautiful

How Interest Rates Dramatically Change Affordability Of A Median Priced Home In San Diego A Loss Of 91 000 Purchase Power With A One Percent Rate Increase R Sandiego

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Texas Home Buying What Are Mortgage Points And Should You Buy Them